1. Overview of the U.S. Plant-Based Supplement Market in 2020

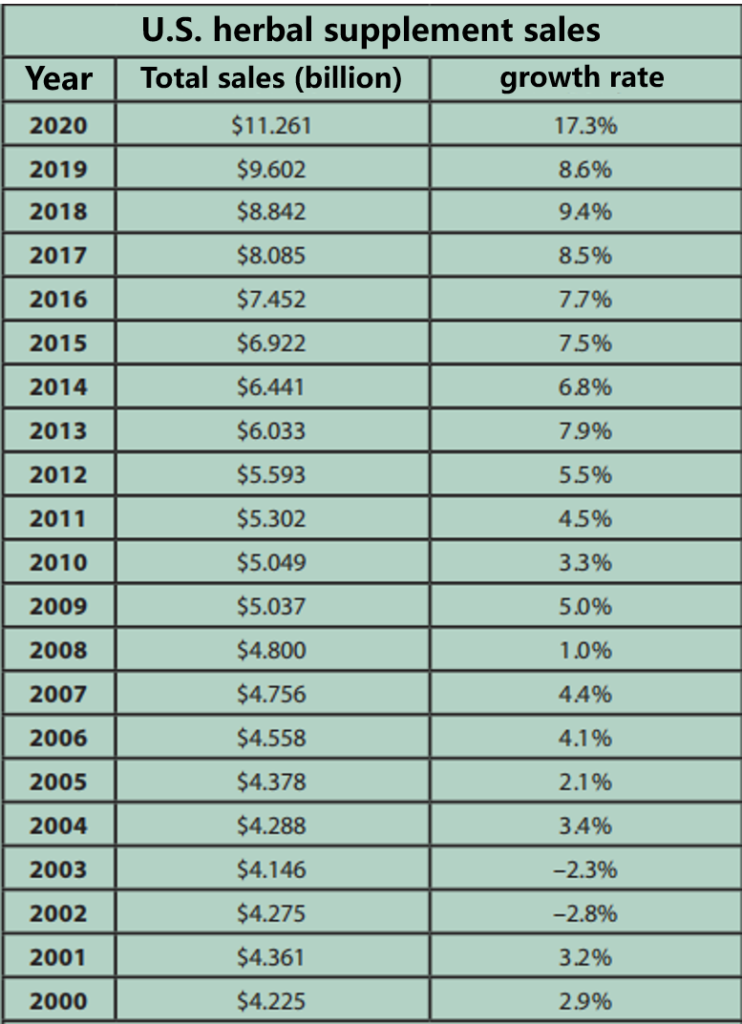

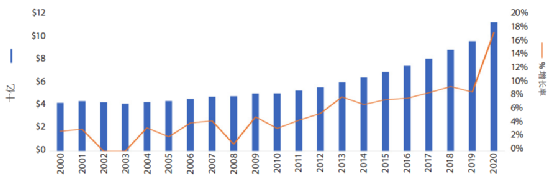

The U.S. plant-based supplement market has been experiencing robust growth in recent years, and in 2020, it achieved a remarkable double-digit increase. Data shows that the market's sales surged to historical highs, surpassing $10 billion for the first time, reaching $11.261 billion, a growth rate of 17.3% compared to 2019.

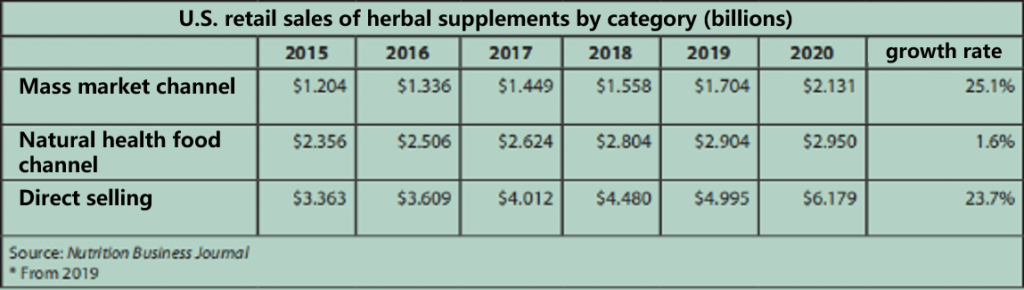

In addition to the overall growth in sales of plant-based dietary supplements, all market channels experienced increased total retail sales in 2020. The mass-market retail channel (including pharmacies, convenience stores, etc.) reported sales of $2.131 billion, a year-on-year increase of 25.1%. Direct selling channels (including online purchases, TV shopping, etc.) reported sales of $6.179 billion, with a year-on-year growth of 23.7%. The natural health food channel (including Whole Foods, GNC, etc.) reported sales of $2.950 billion, a modest increase of 1.6%.

2. Top 40 Bestselling Plant-Based Ingredients (Mainstream Channels)

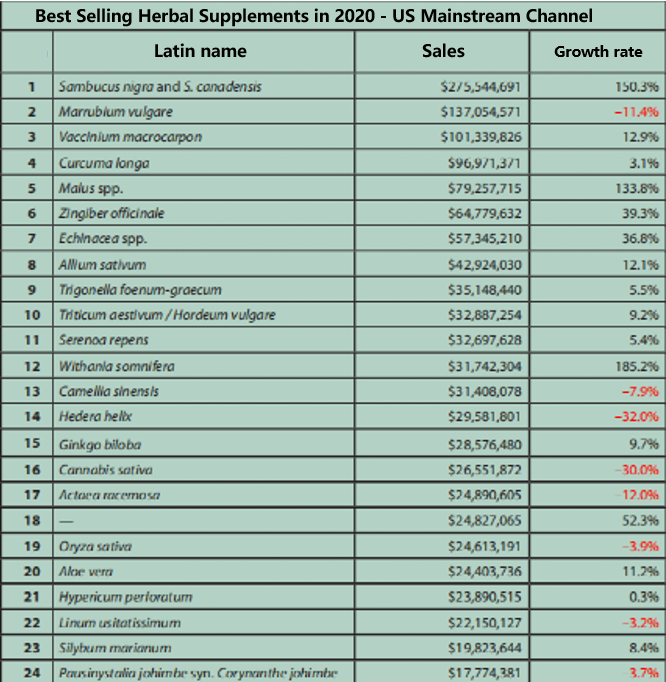

In mainstream channels, the top 20 bestselling plant-based ingredients were elderberry, peppermint, cranberry, turmeric, apple cider vinegar, ginger, echinacea, garlic, fenugreek, wheatgrass/barley grass, saw palmetto, African dream herb, green tea, ivy leaf, ginkgo biloba, beta-sitosterol, red yeast rice, and aloe vera.

Compared to previous years, the most significant change was the decline of peppermint and echinacea, which have consistently held top positions, now sliding to second and seventh place, respectively. Elderberry, cranberry, and apple cider vinegar ascended to the first, third, and fifth spots. Ivy leaf experienced a considerable drop and exited the top ten, while turmeric maintained its fourth place despite a slow increase.

The COVID-19 pandemic led to an explosive growth in elderberry sales due to its potential benefits in regulating the immune system and maintaining upper respiratory health, making it a popular choice among consumers. However, well-known herbs for flu treatment, such as peppermint, echinacea, and ivy leaf, experienced significant declines. The shift may be attributed to elderberry's lower side effects, greater safety, and better taste, making it more attractive for use in various food and beverage products. The rapid growth of cranberry and apple cider vinegar sales further supports this trend.

2.1 Top Five Bestselling Ingredients in Mainstream Channels

a. African Dream Herb (185.2% YoY Growth)

African dream herb achieved the fastest sales growth in mainstream channels, soaring by 185.2% in 2020, reaching $31,742,304. It first appeared among the top 40 bestselling herbs in mainstream retail in 2018, ranking 34th. As consumers become more familiar with this herb, African dream herb's popularity has rapidly increased, positioning itself as a strong competitor to turmeric, an Ayurvedic herb.

African dream herb is best known for its adaptogenic properties, enhancing the body's ability to cope with stress. Its active compound, kavalactones, functions similarly to plant sterols and can protect the body from the negative effects of stress, assisting the adrenal and nervous systems in mitigating stress-related discomfort. Studies suggest that African dream herb has neuroprotective, anti-stress, antioxidant, immune-regulating, hematopoietic, and anti-aging effects. It also has positive impacts on endocrine, cardiovascular, and respiratory systems.

b. Elderberry (150.3% YoY Growth)

In 2020, elderberry supplement sales in mainstream retail reached $275,544,691, a remarkable 150.3% increase from the previous year. From 2018 to 2020, elderberry sales in this channel doubled each year, propelling the ingredient from 25th place in 2015 to the top spot in 2020. Elderberry is widely used to support immune health and has been used as a herbal remedy to alleviate cold and flu symptoms. A study published in April 2021 on the prevention of viral respiratory diseases with elderberry found that it can reduce the severity and duration of cold and flu, making it a safe option for preventing viral respiratory diseases.

Google searches showed that consumers' interest in elderberry peaked in late March 2020, with one of the associated searches being #elderberry new coronavirus#. Although there is no evidence to support elderberry's efficacy against the coronavirus, it is favored as a safer alternative to prescription drugs for common cold and flu cases, promoting immune system enhancement. Its popularity also arises from the ease of consumption as consumers increasingly seek non-pill supplement forms such as gummies, liquids, and syrups. Elderberry's familiar berry flavor makes it particularly suitable for these formulations.

c. Apple Cider Vinegar (133.8% YoY Growth)

Apple cider vinegar supplement sales in mainstream channels reached $79,257,715 in 2020, growing by 133.8% compared to 2019. Apple cider vinegar has been traditionally used as a food, medicine, preservative, or pickling agent. Its popularity has increased in recent years, largely due to mainstream media, blogs, social media, and celebrity endorsements promoting its potential health benefits. According to SPINS data, apple cider vinegar supplements are primarily marketed for detoxification and digestive health. The availability of better-tasting formulations has also contributed to the increase in sales. Apple cider vinegar supplements are commonly available in capsule, tablet, powder, and recently, gummy forms.

d. Beta-Sitosterol (52.3% YoY Growth)

Beta-sitosterol supplement sales in mainstream channels ranked fourth in terms of growth, with a 52.3% increase compared to the previous year. This is the first time it has entered the top 40. Beta-sitosterol is a plant sterol with a chemical structure similar to cholesterol, found in various plants, including rice, wheat, soy, and peanuts. It is commonly used for benign prostatic hyperplasia (BPH), as well as for cardiovascular health, cholesterol management, and immune health. As numerous studies have confirmed its cholesterol-lowering effects, the U.S. Food and Drug Administration (FDA) has allowed food and beverages containing this substance to be advertised as heart disease preventive.

e. Ginger (39.3% YoY Growth)

Ginger sales in mainstream channels grew by 39.3% in 2020. Ginger is a highly versatile ingredient with a wide range of functions, including immune support, digestion, joint health, weight management, cardiovascular health, beauty, sleep aid, and energy supplementation. It is also a vital flavoring agent. Market Research Future data predicts a compound annual growth rate of 5.1% for the global ginger extract market, reaching $1.332 billion by 2025. Fenaroli & Parini S.p.A., a fragrance and flavoring company, lists ginger as the top flavor of 2021, noting its steadily increasing popularity over the past decade, and predicts that ginger will be incorporated into many innovative food products within three years.

2.2 Top Four Declining Ingredients in Mainstream Channels

a. Garcinia Cambogia (-35.7% YoY Growth)

b. Ivy Leaf (-32% YoY Growth)

c. Cinnamon (-18.2% YoY Growth)

d. Black Cohosh (-12% YoY Growth)

Garcinia cambogia has experienced the most significant decline in sales for two consecutive years. This decline is due to frequent false advertising, leading to negative evaluations, and consumers turning to apple cider vinegar for weight management.

3. Top 40 Bestselling Plant-Based Ingredients (Natural Channels)

In natural channels, the top 20 bestselling plant-based ingredients were elderberry, turmeric, wheatgrass/barley grass, mushrooms (other), aloe vera, African dream herb, oregano, echinacea, flaxseed, milk thistle, echinacea-goldenseal complex, saw palmetto, cranberry, garlic, maca, horny goat weed, black seed, spirulina/chlorella.

3.1 Top Five Bestselling Ingredients in Natural Channels

a. Apple Cider Vinegar (97.7% YoY Growth)

b. Quercetin (74.1% YoY Growth)

Quercetin achieved the second-highest sales growth in natural channels, increasing by 74.1% in 2020. Quercetin is a widely distributed flavonol in the plant kingdom, possessing various bioactive properties. It can combat free radicals, lower the three highs (blood pressure, blood sugar, and blood lipids), alleviate allergies, and support prostate health. According to SPINS data, quercetin supplements were mainly used for respiratory health, cardiovascular health, and prostate health in 2020. Quercetin supplements for cardiovascular health and prostate support increased by 233.1% and 132.2% in sales, respectively, while those for immune health grew by 59.2%.

c. Elderberry (68.2% YoY Growth)

d. Chaga Mushroom (54.9% YoY Growth)

Chaga mushroom supplements entered the top 40 in natural channels for the first time. Also known as birch conk, chaga mushroom is a medicinal fungus that grows on birch trees. Chaga's appearance is hard and dark black. Traditionally used in Russia and East Asian countries for gut health, heart health, and immune health, chaga mushroom is gaining popularity in the U.S. market as an important immune-boosting ingredient.

e. Mushrooms (Other) (41.8% YoY Growth)

The "Mushrooms (Other)" category includes mushrooms such as lion's mane, reishi, and other mushroom extracts. In 2020, this category achieved total sales of $14,986,621 in natural channels, representing a year-on-year growth of 41.8%. Immune and brain health are the primary selling points for supplements containing these mushrooms. Capsules and powders are the most common formulations for mushroom supplements.

3.2 Top Four Declining Ingredients in Natural Channels

a. Gotu Kola (-16% YoY Growth)

b. Turmeric (-13.7% YoY Growth)

c. Cherry (-11.3% YoY Growth)

d. Stevia (-9.7% YoY Growth)

4. The Next Rising Star?

4.1 Immune Health - Camu Camu & Goji Berry

Camu camu and goji berry are both rich sources of vitamin C. Camu camu supplement sales surged by 214% in 2020, making it one of the most sought-after new ingredients in immune and oral beauty products. On the other hand, goji berry, also known as wolfberry, is one of the key herbs in the Ayurvedic formulation Triphala, and it has gained popularity worldwide for its immune, beauty, cardiovascular, and digestive benefits.

4.2 Mushrooms' Fierce Competitor - Microalgae

Algae are among the oldest plants, boasting powerful functions, versatile applications, and high production efficiency. Numerous microalgae are rich in proteins, carbohydrates, lipids, and other bioactive compounds, with some being abundant in polyunsaturated fatty acids. Microalgae are also considered vital sources of vitamins (such as A, B1, B2, B6, B12, C, and E), minerals (such as potassium, iron, magnesium, calcium, and iodine), and antioxidants. Their wide range of beneficial properties includes boosting the immune system, antioxidant effects, weight management, cardiovascular and brain health, and more, making them suitable for various health applications.

In recent years, algae have garnered increased attention from businesses and industries, particularly due to their potent functions and high production efficiency. According to Credence Research data, the global algae product market was valued at $33.9 billion in 2018 and is estimated to reach $56.5 billion by 2027, with a compound annual growth rate of 6.0% from 2019 to 2027. Specifically, the global spirulina market is expected to achieve a compound annual growth rate of around 10% by 2026, estimated to be worth $2 billion. The market share for chlorella extract is expected to grow by over 45% by the end of 2026, reaching approximately $700 million by 2022.

4.3 Brain Health - Bacopa Monnieri Extract

Bacopa monnieri, also known as Brahmi, is a commonly used herb in Ayurvedic medicine, primarily used for stress relief and memory enhancement. Research indicates that Bacopa monnieri and its extracts have neuroprotective properties. Bacopa monnieri and its ethanol extract have been shown to significantly improve learning ability in rats, mainly due to the active saponins, bacopaside A and B, found in the ethanol extract. Bacopa monnieri is now widely used in various cognitive and brain health supplements, and its market is expanding steadily.

4.4 Gut Health - New Potential Prebiotics such as Monkey Breadfruit

The monkey bread tree is one of Africa's most iconic trees, and its fruits are large and nutritious. The fruit's pulp contains over 50% fiber, providing a strong sense of fullness. It is a low glycemic index prebiotic and is rich in potassium, calcium, magnesium, other minerals, proteins, and vitamins. Monkey breadfruit powder can be easily incorporated into various food and beverage applications, offering a mild lemon flavor, and is commonly used in various meal replacement and energy drinks.

In 2008, dried monkey breadfruit powder was authorized as a safe food ingredient in the European Union. The FDA also granted this ingredient Generally Recognized As Safe (GRAS) status the same year. However, this fruit ingredient did not receive much attention for a long time. Globally, the average annual growth rate of new products containing monkey breadfruit ingredients was 53% from 2013 to 2017, but the base number was small.

References:

Wieland LS, Piechotta V, Feinberg T, et al. Elderberry for prevention and treatment of viral respiratory illnesses: A systematic review. BMC Complementary Medicine and Therapies. 2021;21. Available”

Please note that this article does not constitute financial advice and is solely intended for informational purposes. Readers are encouraged to consult with industry experts and professionals for investment and business-related decisions.

One Response