Market research in Japan shows that there are differences in the health benefits sought by male and female consumers. Men generally prefer foods or supplements that can help them recover from fatigue, exercise, and maintain good health. Women tend to look for more beauty and weight loss-oriented products, such as those that are beneficial to skin care, provide nutritional support, and reduce fat. During my study in Japan, the author also worked part-time in the nutrition and food industry. This article will analyze and learn from the development experience of Japanese nutritional functional foods to inspire the future development of the entire supplement industry.

1. Sports nutrition market: the emerging niche functional food track

Overall, the development of Japan's functional food industry is inseparable from policy promotion. Japan's functional foods are divided into three categories: specific functional foods, nutritional functional foods, and functional labeled foods, and are classified and graded. The market is mature and saturated. Looking back on the history of Japan's health care products industry, there have been three policy adjustments. Under the condition of slowing market growth, the widening of policy thresholds has stimulated the growth of the industry scale.

Before 2005: Japan experienced the transition from the third to the fourth consumer era, experienced a bubble economy and financial bankruptcy, and the lipstick effect was obvious under the economic depression; at the same time, the aging of the Japanese population and the increase in consumer medical expenses stimulated the rapid growth of the health care products industry.

After 2005: Overall, the growth rate of functional foods in Japan fell from a high level to a low-to-mid single-digit level, and once turned into negative growth under the impact of the epidemic. This is mainly because the industry has passed the rapid growth period. Under the impact of the earthquake and the lack of domestic demand, even the introduction of the functional labeling system did not change the trend of slow growth in the industry. But this does not mean that the functional food industry has no bright spots. Among them, the sports nutrition market, a sub-industry, quickly heated up after the introduction of the policy, once breaking through 25% of the growth, and its share in the health care products industry increased from 4.2% in 2009 to 11% in 2023.

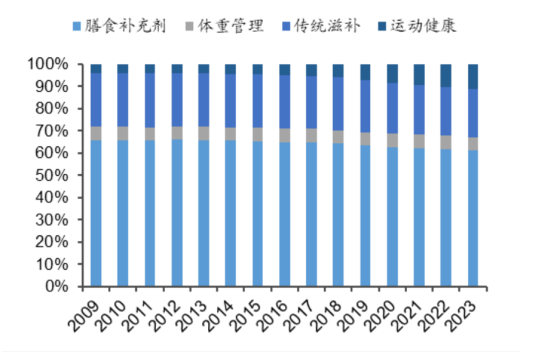

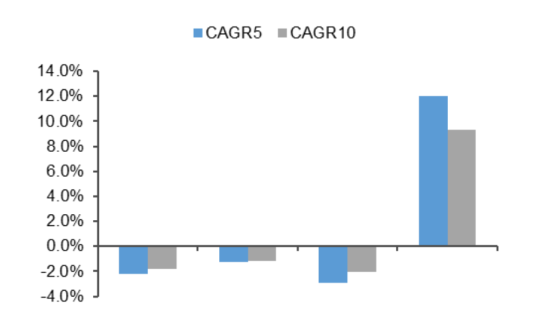

Looking at the various sub-markets of functional foods in Japan, the scale of dietary supplements is still the largest in the industry, and the field of sports nutrition has gradually emerged, with a compound growth rate of 12% in the past five years. According to Euromonitor, from 2009 to 2023, the dietary supplement industry share showed a shrinking trend, but it still had a significant gap with other industries, and its share has remained at the top 1; the overall scale and share of the traditional tonic and weight management industries have decreased; the sports nutrition market has the smallest share, but it has shown a clear upward trend, with CAGR5 and CAGR10 of 12.0%/9.3% respectively. As of 2023, the four sub-industries of functional foods, dietary supplements/weight management/traditional tonic/sports nutrition, accounted for 61.2%, 6.0%, 21.7%, and 11.0% of the total market share, respectively. Sports nutrition surpassed weight management to become the third largest market for functional foods.

2. Policy support and the rise of health awareness

From the perspective of Japanese per capita protein intake, in recent years, the per capita protein intake of Japanese has dropped to the same level as in the 1950s, mainly due to excessive dieting and the perception of excessive focus on vegetables. The diet has led to insufficient intake. On November 4, 2020, Meiji released a related study that demonstrated for the first time that there is a general positive correlation between daily protein intake and increased muscle mass. Sports nutrition products are gradually rising to meet the daily protein supplement needs of fitness groups and ordinary groups. So far, there are two main paths for different types of companies to participate in the health food industry chain:

● Register and apply to become specific functional foods, but most of these companies are large manufacturers that can complete the entire industry chain from product planning to manufacturing and sales.

● Apply to become functional labeled foods and nutritional functional foods with relatively low development costs. Most of these companies focus on product planning and advertising, and outsource production.

Consumers' demands for functional foods have gradually changed from additional attributes of beautifying life to attributes of disease prevention/health enhancement in daily life. The weight loss trend and the fitness awareness brought about by the epidemic are conducive to the development of the sports nutrition market. At different stages, Japanese consumers have different focuses on the efficacy of health products. According to Yano Research Institute, health maintenance and promotion products such as green juice, basic nutrients such as VC, and beauty products such as hyaluronic acid occupy the top three. However, due to the accumulation of neutral fat and visceral fat caused by modern lifestyles, people of all ages have begun to pay attention to "abdominal fat and weight loss", and the demand for products with beauty attributes other than health, such as VC and hyaluronic acid, which focus on whitening and anti-aging, has shown a downward trend. The scale of lactic acid bacteria with intestinal regulation function has shown a rapid growth, and it is expected to show a continuous growth trend in the future. According to a public opinion survey conducted by the Japanese Sports Agency, more and more people are aware of the importance of enhancing immunity and basic physical strength. The top three reasons for people to improve fitness are [no longer busy at work], [preventing the new crown], and [establishing an interest in sports]. The improvement of people's awareness of fitness and improving health immunity has laid a mass foundation for the growth of the sports nutrition market.

3. "Appearance Economy" and "Health Economy" Coexist

Grand view research data shows that the global women's health market size in 2021 is US$38.11 billion, and the compound annual growth rate (CAGR) is expected to be 4.8% from 2022 to 2030. Market growth can be attributed to the increase in the elderly female population and the continuous introduction of new products for women's health. For women's health, the Japanese market has launched a series of products for different periods and different health problems. According to data from Yano Research Institute, the market size of women's care and Femtech (consumer products and services) in Japan grew to 59.708 billion yen in 2020, a year-on-year increase of 103.9%.

Nutreebio found in its inventory of functional food applications in Japan in 2022 that the number of product applications for weight management and skin care ranked 2nd and 6th respectively.

1) Weight management

Weight loss products are the largest category in the Japanese women's health food market. Since the Japanese government added the "Function Labeling Food System" in 2015, more than 4,000 new products have been successfully declared, of which about one-third are products with weight loss as the main purpose.

Popular ingredients: black ginger polymethoxyflavonoids, 3-(4-hydroxy-3-methoxyphenyl) propionic acid (HMPA), allulose, cortisol, tea catechins, soybean β-conglycinin, kudzu flower isoflavones, oligofructose, licorice-derived glabridin, coffee bean-derived chlorogenic acid, gallate-type catechins, hydroxycitric acid (HCA), ellagic acid, rose hip lindens, fucoxanthin, fucose, apple-derived proanthocyanidins, medium-chain fatty acids (caprylic acid, capric acid), Pne-12 lactic acid bacteria, plant lactobacillus OLL2712

Black ginger polymethoxyflavonoids is a star ingredient in the Japanese weight loss market, which can promote fat consumption in daily energy metabolism. Ellagic acid, HMPA, kudzu flower isoflavones, tea catechins, glabridin, fucoxanthin, etc. can reduce abdominal fat (including visceral fat and subcutaneous fat) in people with higher BMI. Food Research has noticed that allulose, a star raw material for sugar substitutes, is also gradually used in weight loss products. Studies have found that allulose can promote fat burning during exercise.

Black Ginger Premium EX contains black ginger polymethoxyflavonoids, which can accelerate fat consumption in energy metabolism and reduce visceral fat and subcutaneous fat.

2) Oral beauty

Japan is the world's largest oral beauty market, and China ranks second only to Japan. As the main force of oral beauty, women are increasingly paying attention to the ingredients and efficacy of products.

Popular raw materials Reduce UV damage: lycopene, astaxanthin, β-carotene, apple polyphenols, cocoa flavanols, lactic acid bacteria Anti-glycation: cherry blossom extract, carnosine, aminoguanidine, lipoic acid, glycosides, chlorogenic acid, vitamin B6, pomegranate extract, mulberry leaf extract, cinnamon extract Moisture retention/skin elasticity: collagen, hyaluronic acid, ceramide, lactic acid bacteria K-1, sulforaphane glucosinolate, eriodictyol-6-C-glucoside, mangosteen peel extract Whitening: niacinamide, grape seed extract, emblica, glutathione, L-cysteine Improve dermatitis: coriander seed oil, Lactobacillus plantarum PBS067, Lactobacillus reuteri PBS072, Lactobacillus rhamnosus LRH020 Anti-hair loss: biotin, keratin

Collagen is the most popular ingredient in oral beauty. In addition, the market for hyaluronic acid, astaxanthin, and ceramide is also expanding.

Nutreebio's collagen gummy helps protect the skin from UV damage, protects skin exposed to UV from dryness, and maintains skin moisture.

3) Premenstrual syndrome (PMS), menstrual pain

Premenstrual syndrome, referred to as PMS, is a combination of physical and emotional symptoms that many women (over 90%) experience after ovulation and before menstruation. A few days after ovulation, estrogen and progesterone levels begin to drop sharply, and changes in hormone levels can trigger PMS to a certain extent. PMS symptoms mainly include bloating, headaches, fatigue, drowsiness, depression, low mood, etc., and the symptoms disappear after menstruation. A report jointly released by CBNDATA and Auntie App pointed out that among women's daily physiological health problems, dysmenorrhea is the most troubled physiological symptom for female users.

Popular ingredients: calcium, vitamin B6, magnesium, polyunsaturated fatty acids, cramp bark, chastity berry, angelica, peony, Poria, Atractylodes, Alisma, cinnamon, peony bark, rhubarb, peach kernel, ginseng, ginkgo leaf extract, saffron extract

Nutreebio's PMS gummy can effectively suppress various symptoms of premenstrual syndrome, dysmenorrhea, menstrual back pain, cold syndrome, anemia and other physical discomfort caused by hormonal disorders during menstruation. The main ingredients added include angelica, Chuanxiong, peony, Poria, Atractylodes, Alisma, cinnamon, peony bark, rhubarb, peach kernel, ginseng, multivitamins, etc.

4) Menopausal syndrome

Menopause often occurs between the ages of 45 and 55. When menstruation has not occurred for 12 consecutive months (excluding pregnancy), it can be diagnosed. Menopause is a natural physiological process with various physiological symptoms, such as hot flashes, chills, night sweats, sleep problems, mood changes, weight gain and slow metabolism, thinning hair and dry skin.

Menopause and supplements suitable for the entire life cycle are popular categories of women's products. Women are looking for herbal medicines with significant efficacy that have been clinically studied and dietary supplements that they can identify with. According to the United Nations World Health Organization, there will be 1.2 billion menopausal or post-menopausal women in the world by 2030. The global health care product market for women's menopausal symptoms is expected to exceed US$50 billion in 2025, with a compound growth rate of 16.4% from 2016 to 2025.

Popular ingredients: maritime pine bark extract, Bacopa monnieri extract, ashwagandha extract, evening primrose oil, red clover extract, angelica root extract, chasteberry, licorice extract, black cohosh extract, equol, fenugreek extract, soy isoflavones

5) Maintaining peripheral body temperature

Main ingredients: ginger polyphenols (6-gingerol, 6-shogaol), piperine from Piper longum, camellia saponin B2, aged garlic extract, monoglucosyl hesperidin, carvacrol and thymol (from winter fragrance), black bean polyphenols, cocoa polyphenols (such as flavanols), ellagic acid

These ingredients mainly have the function of regulating the blood flow (peripheral blood flow) reduced by cold and reducing the decrease in peripheral (hands and feet) skin surface temperature caused by cold. They can be used in cold seasons and summer air-conditioned environments, mainly for women who are afraid of cold.

6) Relieve nighttime leg swelling in women

Main ingredients: Piperine from Piper serrata, monoglucosyl hesperidin from lemon.

Piperine from Piper serrata and monoglucosyl hesperidin from lemon are two ingredients commonly used in functional labeled foods in Japan that claim to relieve nighttime leg swelling in women.

Piperine can normalize peripheral blood flow reduced by cold and reduce the decrease in peripheral skin surface temperature caused by cold. It can also reduce nighttime leg swelling in healthy women. In an experiment on healthy Japanese adult women with leg swelling, the group that consumed 120 μg of Piper serrata extract daily was significantly inhibited from losing water content in the legs due to sitting load, confirming the effect of reducing transient leg swelling.