In the evolving landscape of health and wellness, herbal supplements have carved a niche, emerging as a beacon of natural remedies and holistic health approaches. As we delve into the intricacies of this burgeoning market, the American Botanical Council's just-released of the "2022 U.S. Herbal Supplement Market Report" offers a treasure trove of insights and trends that are shaping the industry. This report, bolstered by retail sales data from SPINS and Nutrition Business Journal (NBJ), provides a comprehensive overview of the market dynamics, consumer preferences, and the standout ingredients that are steering the course of the herbal supplement industry in the United States.

The allure of herbal supplements has been undeniable, with their roots deeply entrenched in centuries-old traditions and modern-day wellness practices alike. Their rise to prominence is not just a testament to their perceived health benefits but also reflects a broader shift towards natural and preventive health solutions. However, the year 2022 presented a unique set of challenges and surprises, marking the first decline in sales in nearly two decades—a pivotal moment that beckons a closer examination.

As we embark on this analytical journey through the 2022 market landscape, we aim to unravel the factors contributing to this unexpected downturn and highlight the ingredients that continue to captivate the American consumer. From the steadfast popularity of psyllium and the resurgence of turmeric in natural channels to the remarkable ascent of spirulina and guarana in mainstream retail, the report sheds light on the evolving consumer trends and the ever-changing tapestry of the herbal supplement market.

This blog post endeavors to not only interpret the key findings of the 2022 report but also to contextualize them within the broader narrative of health and wellness. By doing so, we aspire to provide our readers with a nuanced understanding of the current state of the herbal supplement industry and a glimpse into its potential future trajectories.

1.Market Dynamics Analysis

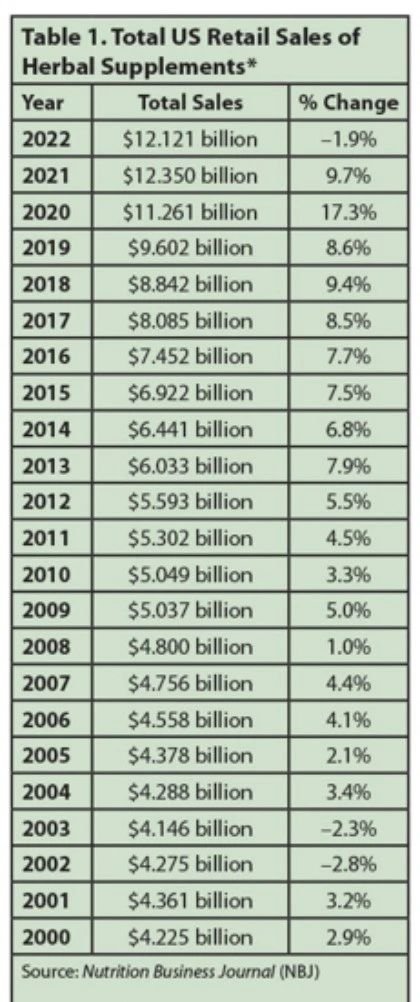

The year 2022 stands out in the annals of the herbal supplement industry, not for its anticipated growth, but for the surprising downturn it witnessed. According to the American Botanical Council's report, fortified by sales data from SPINS and Nutrition Business Journal (NBJ), the sector experienced a slight contraction of -1.9%, a deviation from the robust growth trajectory observed in the preceding years. This downturn marks the first of its kind in nearly two decades, a phenomenon that merits a closer examination against the backdrop of the industry's historical resilience and growth.

1.1The Unprecedented Sales Decline

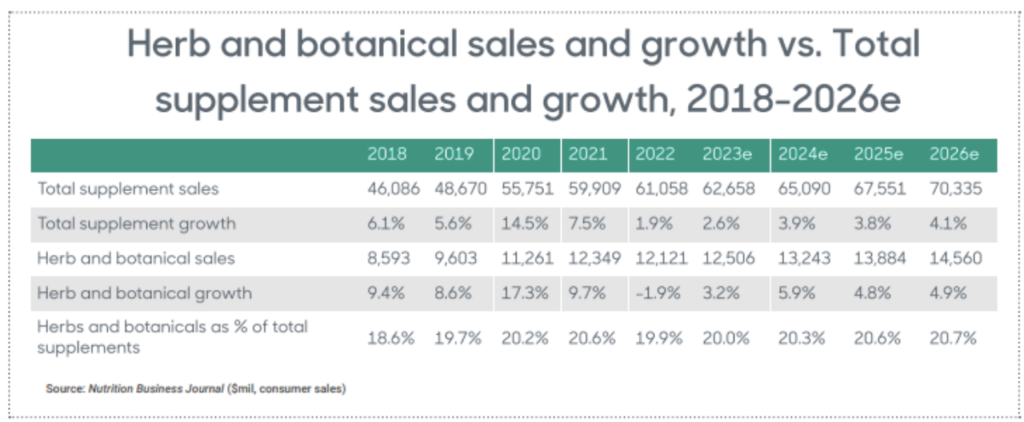

Historically, the herbal supplement category has been a powerhouse within the broader supplement industry, consistently outpacing overall market growth with its diverse range of ingredients and health applications. From 2018 to 2021, the growth rates of herbal and botanical supplements consistently surpassed those of the total supplement market, with figures like +9.4% vs. +6.1% in 2018 and an impressive +17.3% vs. +14.5% in 2020, underscoring the category's robust demand. However, 2022 brought a stark reversal of this trend, with the herbal supplement sector's revenue declining to approximately $12.21 billion, down by $229 million from the previous year. This dip, while modest, signals a notable shift in consumer spending and market dynamics.

1.2Spotlight on Psyllium and Turmeric

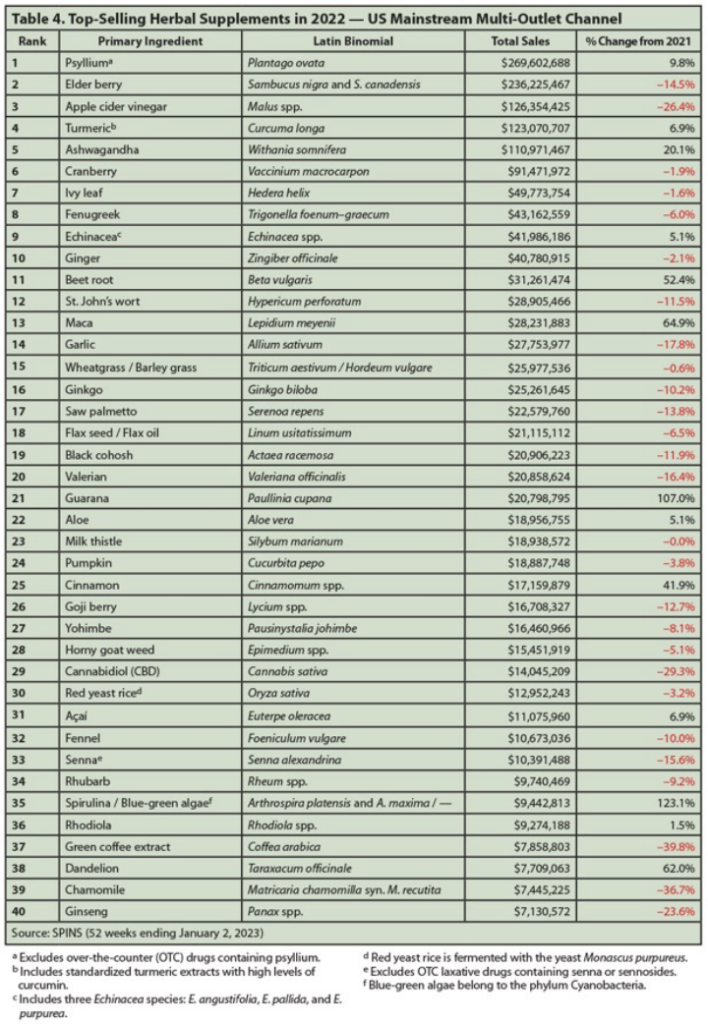

Despite the overall market contraction, certain ingredients stood their ground, demonstrating resilience and continued consumer appeal. Psyllium, a fiber sourced from the Plantago ovata plant, emerged as the top-selling herbal supplement ingredient in mainstream retail channels, with sales surging to $269 million, marking a 9.8% increase from the previous year. The enduring popularity of psyllium can be attributed to its well-documented benefits for digestive and cardiovascular health, which align with consumers' growing preference for natural and functional foods.

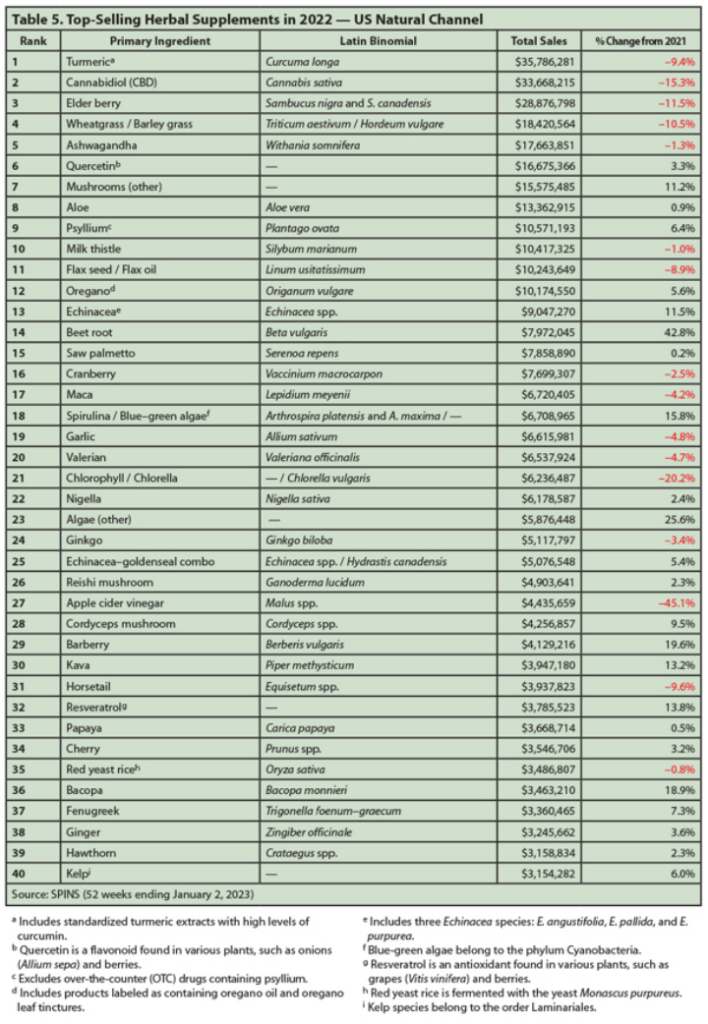

Turmeric, revered for its anti-inflammatory and antioxidant properties, reclaimed its crown in the natural channel segment. Although its sales experienced a slight dip from the peak reached in 2018, turmeric's standing as the most sought-after ingredient in natural health stores underscores its entrenched position in the wellness landscape and consumers' enduring trust in its health benefits.

1.3Emerging Ingredients on the Rise

The report also highlights a cohort of ingredients that have seen remarkable growth in mainstream retail channels, pointing to evolving consumer interests and potential market trends. Spirulina, with its rich nutrient profile and health benefits, led the pack with a staggering 123.1% increase in sales, followed by guarana, maca, and dandelion, among others, each registering significant growth rates. This surge in demand for these ingredients reflects a broader trend towards superfoods and natural supplements that offer unique health benefits, from energy and endurance to detoxification and immune support.

2.In-depth Ingredient Analysis

2.1Psyllium: The Fiber Powerhouse

Psyllium, the leading ingredient in the mainstream market, owes its popularity to its versatile health benefits, particularly in supporting digestive health and managing cholesterol levels. Extracted from the husks of the Plantago ovata plant's seeds, psyllium is rich in both soluble and insoluble fibers. The soluble fiber forms a gel-like substance in the gut, aiding in digestion, while the insoluble fiber helps in maintaining regular bowel movements, making psyllium a staple in many dietary supplements aimed at enhancing digestive wellness. The 9.8% growth in sales, amounting to $269 million, reflects the growing consumer awareness and preference for natural solutions to digestive health.

2.2Turmeric: The Golden Spice of Wellness

Turmeric has long been celebrated for its anti-inflammatory and antioxidant properties, attributed to its active compound, curcumin. This golden spice has a rich history in traditional medicine systems like Ayurveda and Traditional Chinese Medicine (TCM), where it has been used to treat a wide range of ailments, from inflammatory conditions to digestive issues. In 2022, turmeric's slight sales decline in the natural channel did little to diminish its standing as the top-selling ingredient, signaling a strong consumer belief in its health benefits despite the overall market's downward trend.

2.3Spirulina: The Superfood Algae

Spirulina, a type of blue-green algae, has seen an impressive surge in popularity, with sales skyrocketing by 123.1% in 2022. This nutrient-dense superfood is packed with proteins, vitamins (B1, B2, B12, and E), minerals (iron, magnesium, calcium, phosphorus, and zinc), and other bioactive compounds, making it a sought-after ingredient for boosting immunity, antioxidant defense, and cardiovascular health. The dramatic increase in sales to $9.44 million in mainstream retail channels underscores spirulina's rising profile as a holistic dietary supplement.

2.4Guarana: The Natural Energizer

Guarana, another ingredient that saw a significant uptick in consumer interest, is known for its natural caffeine content, which provides a sustained energy boost without the crash associated with synthetic caffeine sources. In 2022, guarana supplements garnered $20.8 million in sales, a testament to its growing appeal among consumers seeking natural alternatives for energy and cognitive enhancement. The 107% increase in sales highlights the shifting consumer preferences towards plant-based stimulants and wellness products that support an active lifestyle.

3.Consumer Preferences, Market Recap, and Herbal Supplement Trends

3.1Shifts in Consumer Preferences

The herbal supplement market's landscape in 2022 was significantly influenced by changing consumer preferences, underscored by a heightened awareness and prioritization of health and wellness. The shift towards natural, organic, and non-synthetic ingredients has been a driving force, with consumers increasingly seeking supplements that offer holistic health benefits, minimal side effects, and sustainable sourcing. This trend is reflected in the continued popularity of traditional ingredients like psyllium and turmeric, alongside the rising interest in superfoods like spirulina and natural energizers like guarana. The demand for products that support digestive health, immunity, cognitive function, and energy levels highlights a collective move towards preventive healthcare and natural wellness solutions.

3.2Market Dynamics Recap

The 2022 market dynamics reveal a complex interplay of factors, with the herbal supplement industry experiencing its first sales decline in nearly two decades. This downturn, while modest, signals a notable shift in the market, potentially influenced by economic factors, market saturation, and the normalization of health and wellness trends post-pandemic. However, the resilience of certain ingredients underscores the enduring consumer trust in the efficacy and benefits of herbal supplements. The market's nuanced performance suggests a recalibration rather than a downturn, with consumers becoming more discerning in their choices and preferences.

3.3Future Herbal Supplement Trends and Predictions

Looking ahead, the herbal supplement market is poised for a nuanced recovery and growth, driven by innovation, research, and evolving consumer needs. The anticipated rebound in sales growth, with projections ranging from 3.2% to 5.9% from 2023 to 2026, suggests a positive outlook for the industry. Emerging trends include a growing emphasis on personalized nutrition, the integration of technology in wellness practices (such as digital health apps and personalized supplement subscriptions), and a continued focus on sustainability and ethical sourcing. Furthermore, the exploration of novel ingredients and the fusion of traditional knowledge with modern science are likely to introduce new frontiers in herbal supplementation.

As we navigate this evolving landscape, the herbal supplement market's resilience, adaptability, and alignment with consumer health and wellness values ensure its continued relevance and growth. The industry's ability to respond to consumer preferences, innovate, and uphold quality and transparency will be key in shaping its future trajectory.