Not long ago, the tea industry in Shanghai, China, began to implement the "grading system", and brands such as Bawang Chaji, Nayuki's Tea, Happy Lemon, and CHALI became the first batch of pilot companies for the "Nutritional Choice" logo in Shanghai.

Unexpectedly, many fresh food e-commerce platforms have also recently announced that they will join the ranks of "Nutritional Choice" logo grading.

For example, "Dingdong Maicai" currently has nearly 200 product SKUs that have completed grading and labeling, all of which have been reviewed by the quality control department. In the future, "Dingdong Maicai" will continue to grade beverages and foods on the platform to help consumers choose beverages that meet their needs more conveniently and quickly.

So, how did the wind of "beverage nutrition grading" blow? Is the participation of e-commerce companies this time just a simple follow-up? What does grading mean to consumers and companies respectively?

1. Origin

The development of things always has a cause, and so does beverage grading.

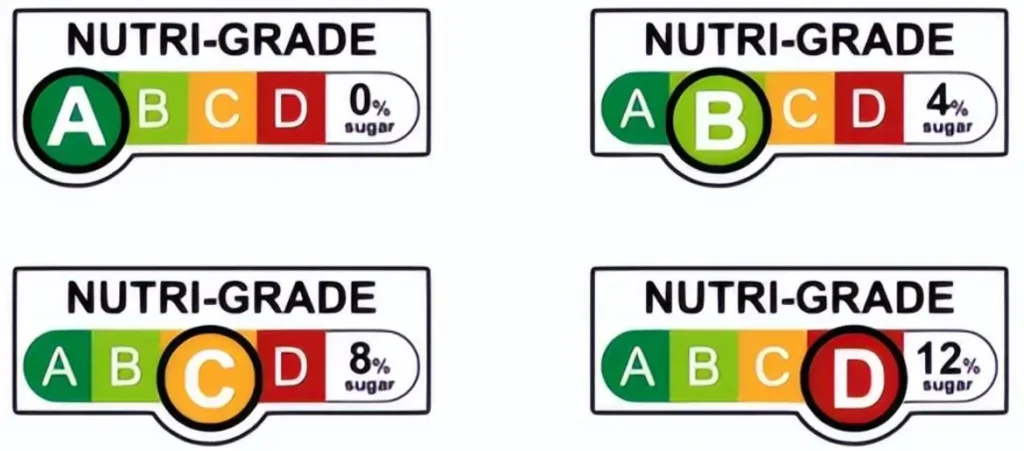

At the end of 2022, Singapore will be the first in the world to launch a beverage grading system, requiring packaged beverages on sale to be printed with nutrition grade labels similar to "traffic lights". At the end of last year, Singapore further required that the ready-mixed beverages sold in designated places must be divided into four grades, ABCD, according to the proportion of sugar and saturated fat (trans fat).

In Singapore's latest grading system, an important criterion is that the sugar content and trans fat content must meet the standard requirements of the same grade at the same time to be marked with the corresponding grade.

In addition, the grading system not only requires beverages to be labeled with Nutri-Grade, but also imposes corresponding restrictions on the marketing level, prohibiting the release of advertisements related to D-grade Nutri-Grade beverages.

Behind the seemingly harsh measures, there is a considerable degree of helplessness: on the one hand, Singapore's population is aging seriously, and the proportion of people over 65 years old has exceeded 19.1%. On the other hand, among the continuously rising number of diabetic patients, there are more and more young people aged 30 to 40.

According to the International Diabetes Federation, the diabetes prevalence rate of Singapore's adult population in 2022 is 14.9%, higher than that of Japan and China. Therefore, as early as 2013, Singapore has successively launched fitness activities such as "Good Morning Exercise" and "National Walking Challenge" to encourage people to develop the habit of exercise.

Singapore has also launched a "healthier food development plan" for businesses and a "health screening plan" for the public with government subsidies, hoping to improve the public's health awareness through multiple approaches. The Singapore government even said that it may consider taxing "sugar" in the future.

Reviewing Singapore's path, it will be found that Shanghai's trial of a beverage grading system this year is also traceable.

In April 2022, China released the latest version of the "Dietary Guidelines for Chinese Residents (2022)" (hereinafter referred to as the "Guidelines"). Compared with the old version in 2016, two suggestions related to "sugar" in the new version have attracted people's attention.

One of them is to control the intake of added sugar under the principle of "less oil, less salt, control sugar and limit alcohol", and it is recommended that people control the intake of added sugar to no more than 50g per day, preferably less than 25g; the other is to recommend that people do not drink or drink less sugary drinks.

Of course, this is also because some data are shocking. The "Guidelines" show that the overweight and obesity rate of children and adolescents aged 6 to 17 in China is as high as 19%. That is to say, about one in five children and adolescents in China is overweight or obese, and this proportion was 18% in 2015.

According to the latest data released by the International Diabetes Federation (IDF), as of 2021, there are about 537 million patients worldwide, and the number of diabetes patients in China has reached 141 million, with an incidence rate of 12.8%. This does not include people at high risk of diabetes or some "pre-diabetic" people with impaired insulin.

Diabetes is a metabolic disease, and sugar is not the only "murderer", but it has become a consensus that high-oil and high-sugar eating habits will cause obesity and eventually lead to a series of health risks.

It is imperative to control sugar and fat, and beverage classification is just the beginning.

2. The classification scenario continues to extend

As people's health awareness increases, the healthy upgrade of consumer products is the general trend.

Not long ago, Shanghai launched the first batch of nutrition and health instructor pilot projects, and implemented a "classification system" for freshly made tea drinks. Judging from the results of more than three months of implementation, some consumers said that they already knew about the grading and would consciously choose products with healthier grades when choosing milk tea. Some consumers also said that they would not pay much attention to the grading and would only choose according to the taste. After all, choosing milk tea is for happiness.

Although the current grading system stipulates that only drinks without any sugar can be rated as A-grade, and drinks with 0-calorie sugar can only be rated as B-grade, it is believed that B-grade drinks can also meet the "sweet" needs of some consumers.

Industry insiders said that starting with the tea drinks that young people often drink is not only a beneficial exploration of sugar control, but also can promote companies in the supply chain and milk tea companies to find a balance between health and taste through research and development innovation.

Of course, sugary drinks are not only in the freshly made tea industry. The sugar content in bottled drinks should not be underestimated, so major e-commerce platforms have gradually begun to try out the "nutritional choice" grading label for drinks on the platform.

For example, the "Nutritional Choice" classification on "Dingdong Maicai" is also based on the standards set by the Shanghai Center for Disease Control and Prevention. It comprehensively evaluates the four indicators of non-dairy sugar, non-sugar sweeteners, saturated fat and trans fat of the products on the platform, and divides beverage products into four levels: ABCD.

Overall, beverage products rated as A and B have lower sugar and fat content than C and D beverages. Of course, the final evaluation still depends on the "short board" items in the four indicators, that is, if a product is scored D in one of the four indicators, the product will be rated as D grade. Only when all four indicators meet the requirements of A grade will it be rated as A grade.

Obviously, the application scenarios of nutrition grading-related standards are extending from the milk tea industry to other industries. In addition to the first batch of pilot enterprises, in the future, in which channels and scenarios consumers can see the nutrition choice grading logo, it is something to look forward to.

3. Low-sugar new era: sugar reduction innovation leads the new trend of food and beverages

According to Innova's global consumer survey, sugar, fat and salt/sodium are the three major ingredients that consumers most consciously limit their intake. Among them, more than 53% of global consumers said they would deliberately reduce their sugar intake. Despite this, people's demand for sweets remains strong. This raises a key question: How to meet consumers' health needs and reduce sugar intake while maintaining the sweetness of the product?

At the Hi & Fi Asia – China 2024 site, Innova Market Insights was invited to attend and delivered a forum speech entitled "A New Era of Low Sugar: Sugar Reduction Innovation Leading the New Trend of Food and Beverages", analyzing the current trends and innovative technologies in the field of sugar reduction, and conducting in-depth insights into sugar reduction innovation from multiple dimensions such as global consumer research, new product launch trends, and technological innovation. This article is a selection of part of the speech report.

A. Sugar Reduction Strategy

Strategic innovation in the field of sugar reduction can be divided into three categories: sugar removal, sugar substitution, and sugar reduction technology. According to Innova's global consumer survey, the most attractive ways to increase the sweetness of food and beverages are: using natural sweeteners to sweeten (for example, juice), reducing sweetness (for example, reducing sugar by 10%), and using natural sweeteners to sweeten (for example, stevia).

B. Fiber Ingredients in Sugar Reduction

Fiber ingredients are also increasingly being used in sugar reduction products. The use of fiber ingredients such as inulin, resistant dextrins and inulin agave is growing rapidly. Brands are able to enrich fiber content while reducing sugar by using enzyme technology.

For example, Nestlé has launched a new multifunctional sugar reduction technology that reduces endogenous sugars in ingredients such as malt, milk and juice by up to 30% through an enzymatic process. This solution can also increase prebiotic fiber in dairy products, thereby improving gut health. This approach maintains the excellent taste of the product without adding sweeteners, and the cost increase is very low. The technology was initially tested in cocoa and malt-based ready-to-drink beverages in Southeast Asia, and then expanded to cocoa and malt-based powdered beverages in multiple countries in Asia, Africa and Latin America. [1]

Food technology startup Better Juice has partnered with Ingredion to develop an enzymatic technology that converts simple sugars in juice drinks, concentrates and other naturally sweetened liquids into non-digestible compounds such as dietary fiber and non-digestible sugars. At the same time, the natural properties of vitamins, minerals and organic acids in the final product are maintained. In this way, sugar from any natural source can be reduced, which is a technology different from replacing sugar with sweeteners and changing the formulation. It provides a comprehensive solution to meet the market's demand for sugar reduction. [2]

C. Raw material innovation: Advanced technology drives new discoveries in sweet proteins

The application of sweet proteins is also a breakthrough in the field of sugar reduction. MycoTechnology, a company dedicated to mushroom research and innovation, has discovered a natural sweet protein from the rare mushroom honey truffle. It is reported that honey truffle sweetener has a sugar-like taste without the negative aftertaste of common natural sweeteners. It will be classified as a non-nutritive, high-intensity sweetener. Although it has the same calories as other proteins, its sweetness is 1,500 to 2,500 times that of sugar, so its caloric value is negligible. [3]

Sweegen has launched its latest flavor tool to help food and beverage manufacturers create low-sugar healthy products. Its new protein technology can improve and adjust sweetness. Sweetensify Flavors can be used in a variety of products such as soft drinks, energy drinks, ready-to-drink cocktails, hard soda, chocolate, granola bars/cereal bars, etc. Sweegen uses precision fermentation technology to mass-produce sweet proteins such as thaumatin through its collaboration with Conagen. Compared with traditional fermentation methods, precision fermentation provides higher yields and product quality because it can optimize the production of the required ingredients. [4]

4. From sugar control to clean labels

What do ordinary people pay most attention to when buying food?

According to the "2020 Survey Report on the Awareness and Use of Food Labels by Chinese Consumers" released by the China Food and Health Information Exchange Center, consumers who occasionally look at the ingredient list and nutrition label each account for nearly 50% of the sample, and consumers who never look at the nutrition label account for more than 13%.

The improvement of health awareness is far from enough to rely solely on the guidance of relevant departments or product innovation of enterprises. The degree to which consumers themselves attach importance to health complements external factors.

On the one hand, changes in the consumption environment can promote the upgrading of consumers' health awareness. On the other hand, consumers' personalized needs can also force companies to find opportunities for segmented tracks through innovation.

The rise of "nutritional grading of beverages" is a clear proof. Initially, consumers were concerned about whether the ingredients of skin care products were healthy. Slowly, the field began to expand from skin care products to food and beverages. If you want to take money out of the pockets of this group of people, a clean ingredient list is the only weapon to "conquer" them.

As a result, the wind of "clean label" has blown up again around the world, and some global food companies have begun to participate in and vigorously promote this concept.

Clean label originated from the European Union. From the perspective of consumers, you can simply understand that foods marked with clean labels are not only more natural in themselves, but also do not add any artificial colors or preservatives, and the production process is also simple.

If the understanding is still a little vague, then saying that many common organic foods and non-GMO foods are also clean label foods may be more concrete.

In addition, the "traceability system" that some companies have begun to implement is also another way to help consumers identify the healthiness of food.

For example, the "Metro" company launched the Starbucks "Green Label". For any food printed with this green label, consumers can scan the code on their mobile phones to view every link in the entire life cycle of this product.

In fact, whether it is clean labels, traceability systems, or the nutritional grading that has recently attracted widespread attention from the public, the ultimate goal is still to help consumers quickly and efficiently identify products that better meet their health needs.

Zang Jiajie, director of the Nutrition and Health Department of the Shanghai Center for Disease Control and Prevention, said that the "Nutritional Choice" grading logo has currently had a positive impact on society, enterprises and consumers. He hopes that the logo can become an effective tool to help consumers choose healthy food and regulate the production behavior of food companies.

It can be predicted that the birth of the "Nutritional Choice" grading logo is not just a gust of wind, but will gradually penetrate into more industries and cities after continuous optimization and improvement - a new outlet related to "health" is taking shape.

References:

[1]Nestlé cuts sugar in “key ingredients” and boosts fiber with new technology, 14 Jul 2023,Food Ingredients First

[2]Ingredion leads investment round to slash sugar in collaboration with Better Juice, 18 Jan 2024 ,Food Ingredients First

[3]MycoTechnology discovers natural sweet protein derived from honey truffle, 17 Jul 2023 ,Food Ingredients First

[4]Sweegen launches sweet protein brazzein tech set to “push the boundaries” in sugar reduction, 18 Apr 2023,Food Ingredients First