In the first half of 2024, the US dietary supplement market was mixed.

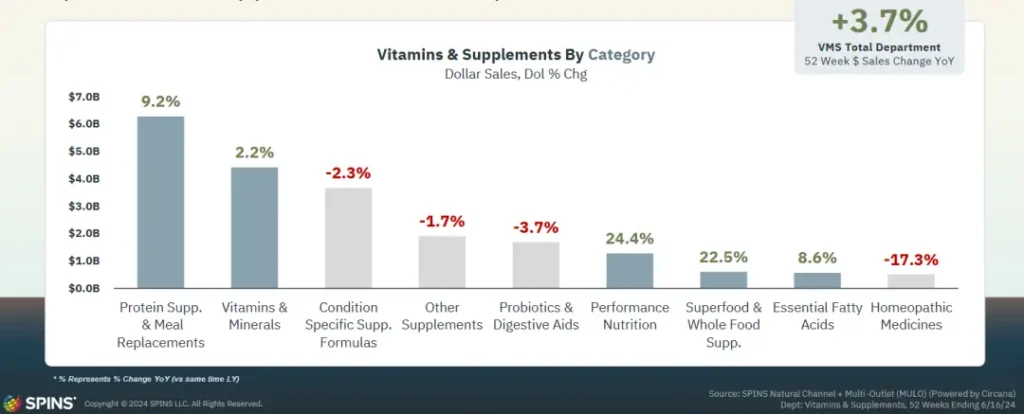

On the one hand, consumers' pursuit of health and natural nutrition has driven steady growth in the market. According to SPINS data, in the 52 weeks ending June 16, 2024, total sales of dietary supplements in the US multi-channel and natural channels (hereinafter referred to as the same) increased by 3.7% year-on-year.

However, market growth was uneven. Certain categories such as sports nutrition supplements (+24.4%), superfood supplements (+22.5%), and protein and alternative meat supplements (+9.2%) performed strongly. At the same time, categories such as specific nutritional formula supplements (-2.3%), probiotics and digestive aid supplements (-3.7%), and homeopathic supplements (-17.3%) declined.

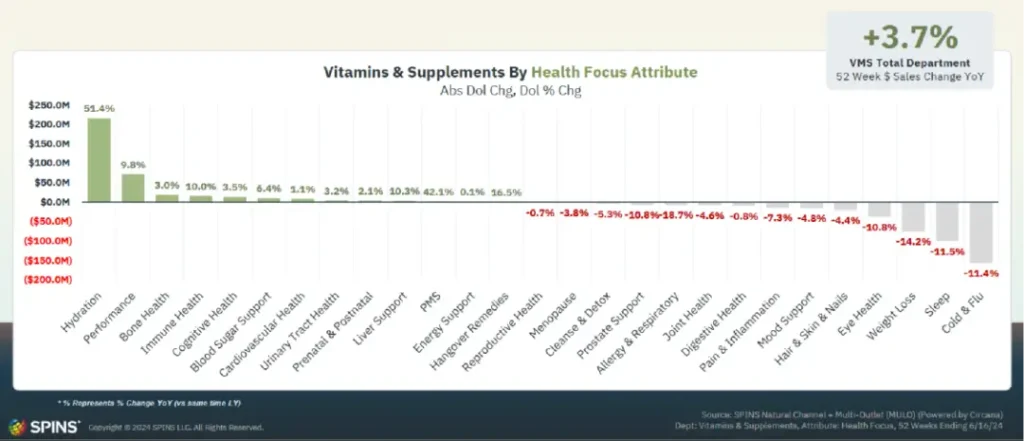

In the health category, hydration supplements ranked first in year-on-year growth rate, reaching 51.4%, with sales exceeding US$200 million. In contrast, sales in the cold & flu category, although ranked second, fell 11.4% year-on-year. In addition, sales in categories such as sleep health, bone health, weight loss, and cognitive health have also experienced certain fluctuations.

On August 27, SPINS released the US dietary supplement trend report for the second half of 2024, in which the rise of probiotics, women's health, and some popular raw materials became the focus.

1. Probiotics: The rise of diversified products

With the improvement of health awareness, probiotics have quickly become popular in the US market due to their positive impact on overall health. In 2021, a survey by the International Food Information Council (IFIC) showed that American consumers consume probiotics for different purposes, such as intestinal health (51%), immune health (33%), overall health (38%), and emotional health (13%). Probiotics have become a key choice for consumers to pursue a healthy life.

According to Mordor Intelligence data, the global probiotics market size is valued at US$8.26 billion in 2024 and is expected to reach US$10.91 billion in 2029, with a compound annual growth rate of 5.72%. Probiotic supplements are popular in a variety of forms, including capsules, gummies, liquids, and powders.

Not just dietary supplements, the launch of probiotic milk drinks such as Yakult has allowed many consumers to be exposed to the concept of food and beverages "aiming to promote health" for the first time. According to a 2024 IFIC survey, a quarter of American consumers said they would look for products containing probiotics when choosing beverages. In order to cater to consumer needs and preferences, the US market has continued to innovate in the fierce market competition and has also launched a variety of probiotic products, covering beverages, snacks and other fields.

2. Women's health: innovation focusing on specific needs

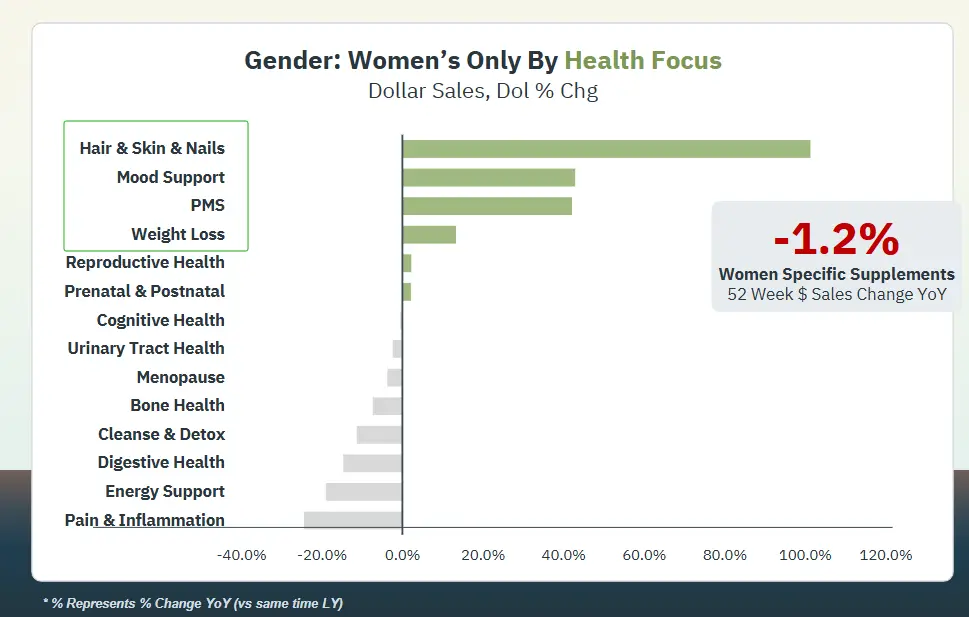

The issue of women's health continues to heat up. According to SPINS data, sales of specific dietary supplements for women's health increased by -1.2% year-on-year in the 52 weeks ending June 16, 2024. Despite the overall market decline, dietary supplements for women's specific needs are showing strong growth momentum, such as oral beauty, emotional support, premenstrual syndrome and weight loss.

Women account for nearly half of the world's population, but many women feel that their health needs are not met. According to FMCG Gurus, 75% of women surveyed said they are taking a long-term approach to health maintenance, including preventive care. In addition, data from Allied Market Research shows that the global women's health and beauty supplements market reached $57.2809 billion in 2020 and is expected to grow to $206.8852 billion by 2030, with an average annual growth rate of 12.4% during the forecast period.

The dietary supplement industry has great potential in supporting women's health management. In addition to adjusting product formulas to reduce sugar, salt and fat content, the industry can also provide solutions for women's specific health problems (such as breast cancer, cervical cancer, and problems related to fertility, pregnancy, menstruation and menopause) and general health challenges (such as stress management, cancer prevention and treatment, cardiovascular health, etc.) by adding functional ingredients.

Nutreebio's PMS Relief Gummies can be added with Chasteberry, Dong Quai, Iron, Vitamin B6, Vitamin B12, Magnesium, Ginger and other nutritional elements. During women's menstrual period, it can reduce bloating, regulate hormones, relieve menstrual cramps and pain, and then reduce mood swings and irritability, thereby relieving fatigue and improving sleep quality.

3. Ashwagandha: The modern charm of ancient herbs

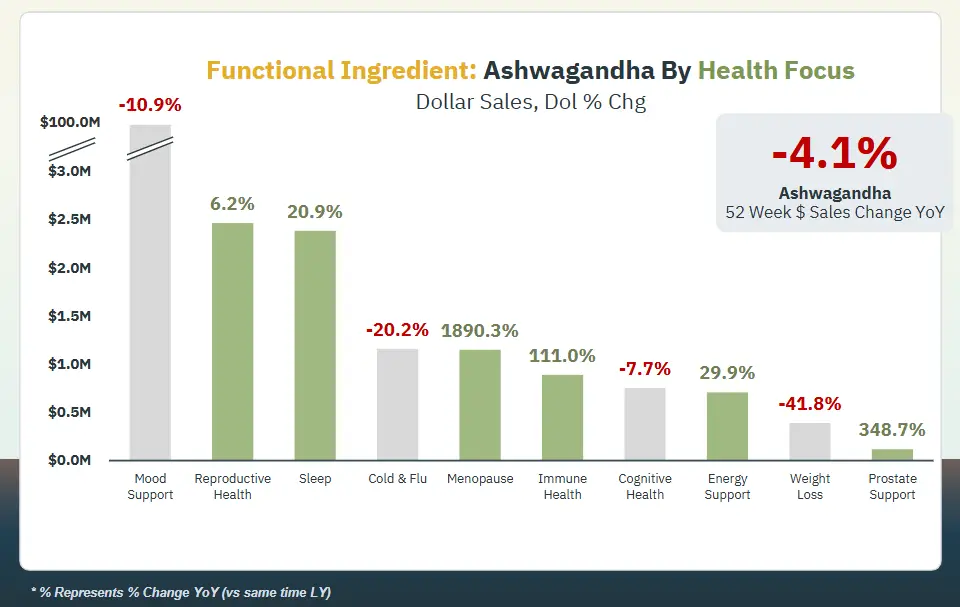

Ashwagandha, a plant with a long history, is capturing the attention of modern consumers with its unique health benefits. According to SPINS data, as of the 52 weeks before June 16, 2024, although the sales of ashwagandha supplements for mood support fell by 10.9% year-on-year, its sales still reached US$100 million, ranking first. In particular, the sales of ashwagandha supplements for women's menopause and men's prostate health have shown explosive growth, increasing by 1890.3% and 348.7% respectively. In addition, the sales of ashwagandha supplements in the fields of sleep health, immune health, energy support, cognitive health, and weight loss show different trends.

The roots and leaves of ashwagandha are rich in alkaloids, saponins, withanolides, and active ingredients such as iron, zinc, and vitamin C, which can improve a variety of health problems such as arthritis, asthma, goiter, ulcers, anxiety, insomnia, and neurological diseases. These effects come from its adaptogenic properties, which can enhance the body's "nonspecific" resistance to various stressors.

The ashwagandha gummy launched by Nutreebio helps support a healthy stress response, promote brain health, and support positive emotions. It can help the body adapt to various stresses that occur in daily life.

4. Mushrooms: The new favorite of nutritional supplements

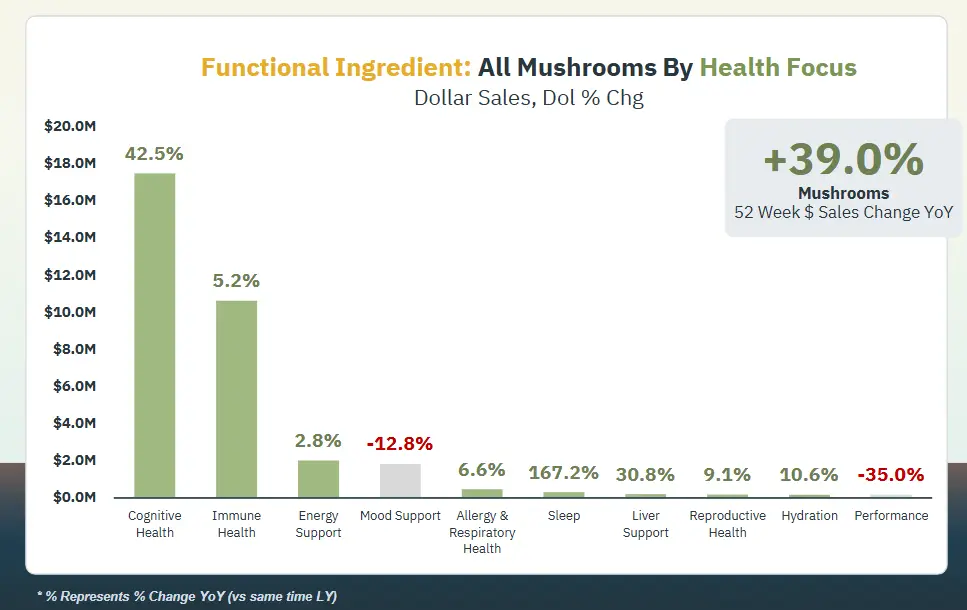

Mushrooms are no longer just a delicacy on the table, and their value in the field of dietary supplements is gradually being recognized by consumers. According to SPINS data, the sales of mushroom supplements increased by 39% year-on-year in the 52 weeks ending June 16, 2024, of which cognitive health mushroom supplements increased by 42.5% year-on-year. At this year's Natural Products Expo West, mushroom products were everywhere, including beverages, coffee powder and gummies, showing the "mushroom craze".

The growing popularity of mushrooms also means that mushroom product labels need to be clearer. "Mushroom" includes two parts: fruiting body (mushroom head) and mycelium. Nammex surveyed 10,000 consumers in the United States and found that most people have limited knowledge of mushrooms. Regarding "fruiting body", 71.5% of respondents said they didn't know what it was. When they saw photos of mushroom fruiting bodies, 90.1% thought it was a mushroom, 12.43% thought it was a fungus, and only 2.8% accurately identified the fruiting body. When seeing photos of mushroom mycelium growing in grain culture medium, a whopping 79.3% of people failed to recognize that it was part of a mushroom.

Often, consumers simply equate "mushroom" with fruiting body. However, dietary supplement manufacturers may use fruiting bodies, mycelium, or a mixture of the two in their products, and only label them as "mushroom" or "mushroom mycelium" on the label. Nammex pointed out that such labels cannot clearly show consumers the true content of the product. Given the wide variety of mushrooms, different types of mushrooms have different effects.

To this end, Nammex submitted a citizen petition to the U.S. Food and Drug Administration (FDA), calling on the agency to update labeling guidelines to require that the specific parts and varieties of mushrooms used in the product be clearly indicated on the ingredient list to enhance product transparency and consumers' right to know.

Nutreebio's Mushroom Gummies are made from completely natural ingredients, do not contain artificial colors or flavors, have Vegan and Non-GMO labels, and can be certified as "halal". This makes our Mushroom Gummies respond well among customers.

5. Magnesium: All-round health guardian

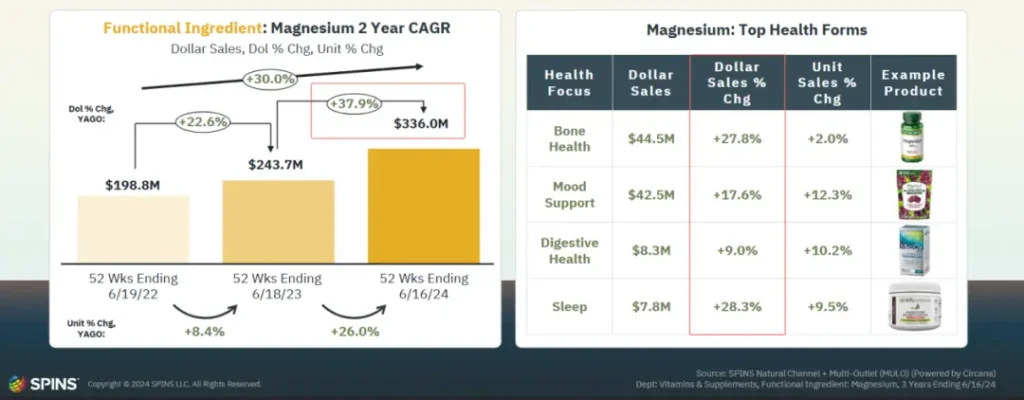

Magnesium is a "holy grail" supplement in the U.S. market. According to SPINS data, magnesium supplement sales increased by 37.9% year-on-year, and unit sales increased by 26% year-on-year, totaling US$336 million. It is worth noting that magnesium supplements have seen significant sales growth in multiple health areas, including bone health (+27.8%), mood support (+17.6%), sleep (+28.3%), and digestive health (+9.0%).

In order to meet the needs of various consumers, magnesium supplements have become diversified, from capsules to gummies, all designed to provide a more convenient way of supplementation. The most common ingredients added to magnesium supplements include magnesium glycinate, magnesium L-threonate, magnesium malate, magnesium taurine, magnesium oxide, magnesium chloride/magnesium lactate, magnesium citrate, magnesium sulfate, etc.

Nutreebio's Magnesium Glycinate Gummies contain a highly absorbable form of magnesium glycinate, which can promote healthy bone and muscle development, stabilize mood and sleep, and will not cause digestive discomfort.

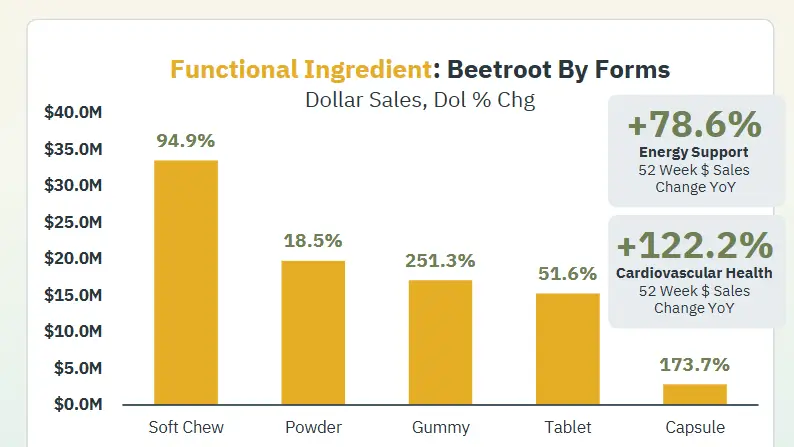

6. Beetroot: The red source of energy and health

Beetroot is becoming a red force in the supplement market with its rich nutritional value and role in promoting cardiovascular health. According to SPINS, beetroot supplements in different dosage forms also showed different growth trends, among which chewable gum tablets increased by 94.9% year-on-year, while the growth rate of pectin candy was as high as 251.3%. At the same time, the sales of beetroot supplements in the fields of energy support and cardiovascular health achieved significant growth of 78.6% and 122.2% respectively.

Beetroot contains a variety of beneficial nutrients, including folic acid, nitrates and betaine, which support cell growth and protect blood vessels, enhance blood circulation and have anti-inflammatory effects. They can reduce the risk of heart disease, improve physical activity endurance, lower blood pressure and promote overall health. According to Future Market Insights, the US beetroot supplement market size reached $143.5 million in 2023, and by 2033, the US beetroot supplement market size is expected to reach $317.9 million.

Nutreebio's Beet Root Gummies support healthy circulation, improve athletic performance and endurance, and are tailored for our client brands' health and wellness lines.

Nuteebio is a supplier of custom gummy supplements for global distributors, wholesalers, brands and retailers. If you have any gummy or supplement needs or customization requirements, please feel free to contact us.